Industrial fasteners demand to increase by 4 percent by 2031

May 7, 2021 5:29 pm

An unbiased analysis of the industrial fasteners market, providing forecast statistics for the period of 2021-2031.

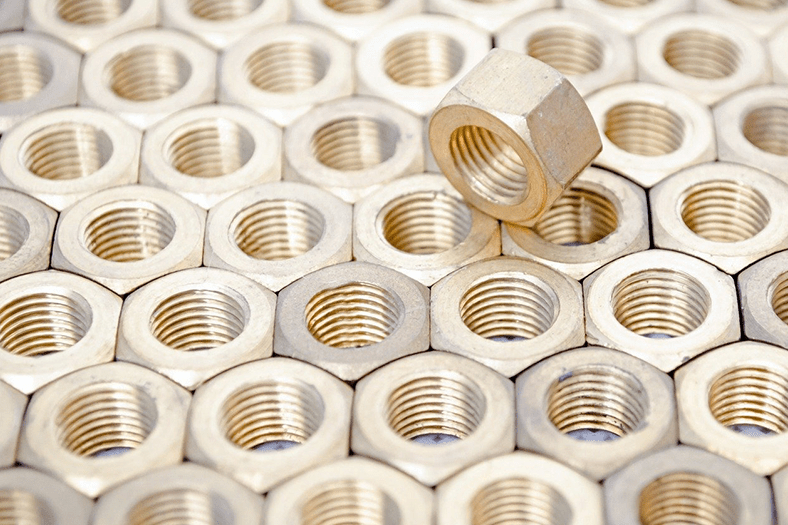

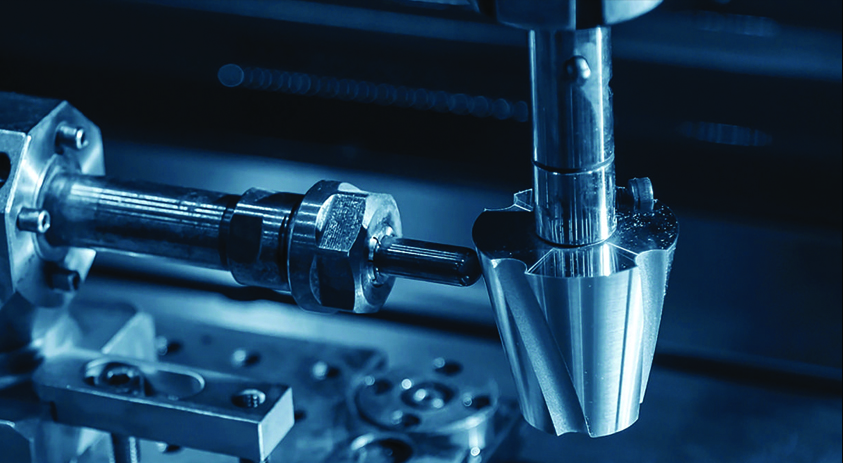

Industrial fasteners are likely to witness significant demand growth owing to high usage in electrical, automotive, and other industrial sectors. Invention of new features such as coatings to fasteners in order to protect them from abrasion and rust are further favouring industry players. According to Fact.MR, focus of suppliers will be on lucrative markets such as the United States, China, Germany and the United Kingdom, to name a few. While industry outlook is forecast to remain positive, adoption of advanced processes such as hot-dip galvanising, zinc and chrome coatings are set to further widen the growth scope for manufacturers. According to Fact MR’s report, the global industrial fasteners market is expected to ascend at over 4 percent CAGR through 2031.

Key Takeaways from Market Study

- High demand for plastic fasteners likely to be witnessed

- Threaded industrial fasteners to gain traction

- Demand from automotive and building and construction sectors to drive sales

- North America to sustain its leading position, with its epicentre being the United States

- Germany to remain in the spotlight in Europe’s industrial fasteners industry

- Asia Pacific to exhibit fastest growth in the global industrial fasteners market

- China, Japan, India, France, Italy and the United Kingdom to remain lucrative markets

With manufacturers bringing in a wider variety of externally and internally threaded industrial fasteners, they are utilising the huge opportunities across diverse end use sectors, from automotive to aerospace.

How is Growing Requirement in Building and Construction Raising the Profit Margins of Manufacturers?

Industrial fasteners play a crucial role in promoting safety by joining two or more objects as far as building and construction is concerned. While the industry suffered a setback due to the outbreak of the deadly coronavirus earlier in 2020, the recovery phase is drawing more potential players since the ending of the year.

According to a report titled “Canada-Architecture, Construction, and Engineering”, published by Select USA on 30th September 2019, the Canada construction sector was valued at $ 126.3 Bn, accounting for over 7 percent of Canada’s Gross Domestic Product (GDP) as in 2019. As stated in the report, the sector purchases goods and services from every region of the country while employing approximately 1.4 million people, as in 2018. This not only indicates the progressive future of the building and construction industry but also new opportunities awaiting industrial fastener manufacturers. According to China – Country Commercial Guide, China’s construction and architectural industry grew 7 percent from 2015 to 2020, while earnings from this sector reached approximately $ 220.8 Bn in 2020. Such figures are pointing towards new growth paths for industrial fastener providers across the world.

Who is winning in this Space?

With the global industrial fasteners space getting stricter in terms of competition, key players are focusing more on the frequency of product launches in order to capture low-hanging opportunities across regions.

For instance

- Stanley Black and Decker, Inc. recently launched its new Stanley Engineered Fastening Solutions, NeoBolt® Installation Tool.

- MW Industries Inc. launched its new Carbon Composite Disc Springs, Coiled Springs and Belleville Custom Disc Springs over the last years.

More Valuable Insights In its latest report

Fact.MR offers an unbiased analysis of the industrial fasteners market, providing forecast statistics for the period of 2021-2031. In order to understand the global market potential, its growth and scope, the market is segmented on the basis of material (plastic and metal), product type (threaded, non-threaded, and aerospace grade) and end user (automotive, building and construction, home appliances, aerospace, and others), across seven major regions of the world (North America, Latin America, Europe, East Asia, South Asia, Oceania and MEA).

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.